How we earn our money

We finance our services on how-to-germany.com through affiliate programs.

When a user orders a financial product through our site and their application is approved, we may receive a commission from some providers. It’s important to note that this does not in any way influence our independent ratings and recommendations.

All the products we present on how-to-germany.com are selected for their quality, range of services, and excellent value for money.

Private Health Insurance in Germany

- In Germany, health insurance is mandatory. Health insurance options in Germany are public or private insurance.

- Private health insurance in Germany almost always offers better coverage than public health insurance. However, you must meet certain requirements to take out private insurance.

- Employees with a gross annual salary of €69,300, freelancers, the self-employed, students, and civil servants can choose between statutory health insurance and private health insurance companies.

- Private insurance in Germany allows you to flexibly structure your healthcare benefits by choosing a suitable tariff.

- The cost of private health insurance depends on the tariff you choose and your age and state of health when you take out the policy.

- For expats in Germany, we recommend the policies offered by the private providers ottonova and Feather, which provide high-performance health insurance plans and offer bilingual services in German and English.

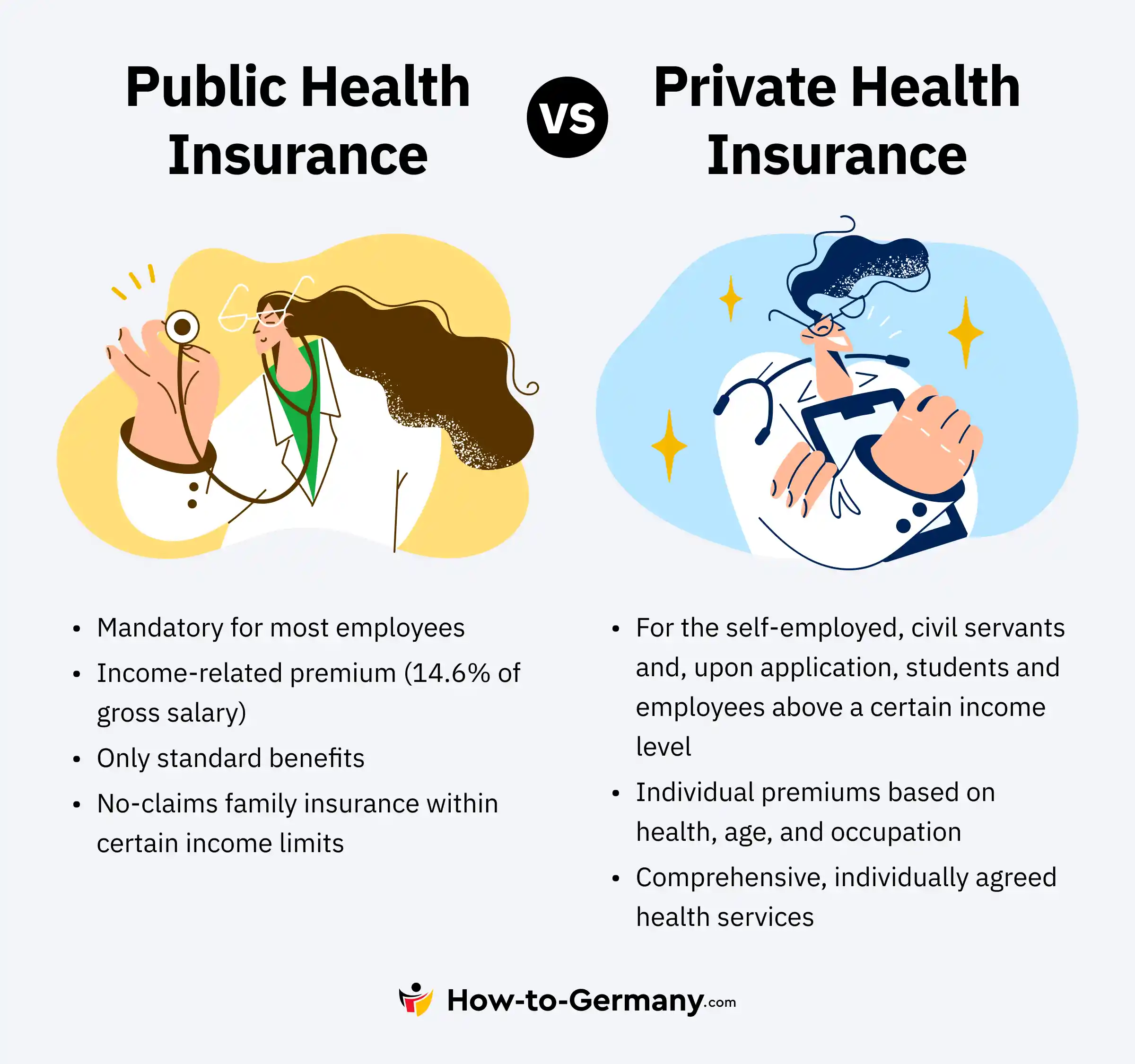

What is the difference between public and private health insurance in Germany?

German health insurance is based on two pillars. In 2020, most people — around 73 million — were covered by statutory health insurance (Gesetzliche Krankenversicherung, GKV), while 9 million policyholders opted for private health insurance (Private Krankenversicherung, PKV). The public and private branches of German health insurance differ in the requirements for taking out insurance and the scope of benefits.

Statutory health insurance in Germany

The compulsory insurance limit for employees is currently a gross annual salary of €69,300. For employees earning less than this, the statutory German healthcare system is mandatory.

Freelancers, the self-employed, civil servants, and students can choose between public and private health insurance options. They are not bound by income limits. Students receive special rates in both public and private insurance.

Contributions to public health insurance depend on income. They currently amount to 14.6% of gross income. For Employees, the employer pays half of it. There are additional contributions to the statutory health insurance providers averaging 1.7% and contributions to statutory long-term care insurance. Under the family insurance scheme, spouses, and children with no or low income can be insured at no extra cost in a statutory health insurance scheme. This beneficial regulation of public health insurance applies to students up to the age of 25.

Statutory health insurance in Germany benefits are identical for all insured individuals and include all standard medical care services, such as ambulant and hospital treatment, remedies, aids, and medication. Co-payments are required for certain services, especially for dentures, vision aids and prescription medicine. Medical fees for certain treatments — such as for additional dental care — beyond standard public insurance coverage must be paid for privately.

A comprehensive overview regarding public health insurance in Germany you also find in our related guides.

Private health insurance in Germany

Private insurance is the second pillar of the German health care system. It differs from public insurance in the following general respects:

- Provided by private health insurance companies

- Financed through capital cover

- Calculation of private health insurance premiums depending on the selected tariff and the individual risk profile

- Privately agreed scope of benefits, benefit security

- Higher remunerations of doctors and other medical service providers

- Billing through reimbursement of costs to the policyholder, who initially pays for medical services (however, costs for hospital treatment are usually settled directly with the private health insurance company).

How does private health insurance work?

When you opt for private health insurance, you conclude an individual contract with the health insurance company tailored to your needs.

Private health insurance companies offer more comprehensive benefits than statutory health insurance. Young people without pre-existing medical conditions usually pay significantly lower premiums for private insurance policies. However, it’s important to note that, in contrast to statutory health insurance, private insurance does not include non-contributory family insurance.

Private health insurance in Germany is a choice for:

- Employees with an income above the compulsory insurance threshold (€69,300 per year, €5,775 per month)

- Freelancers, self-employed people, university students

- Civil servants and their family members

- People with an income below the marginal earnings threshold of €505 (€556 for mini-jobbers)

Some people cannot be insured in the public health insurance system and must take out private insurance. These include freelancers, the self-employed, and people without health insurance who were previously privately insured.

Are there special regulations for expats?

For expats with a long-term residence permit of more than 12 months, the same regulations apply as for all other German residents.

Expats with a shorter stay in Germany require international travel insurance, which must be taken out before entering Germany. This does not apply to EU-citizens, whose medical treatment is also insured via the European Health Insurance Card, and citizens of countries with which Germany has concluded a social security agreement.

Expats from any EU country, Iceland, Norway, Switzerland, and Liechtenstein can use the European Health Insurance Card (EHIC card) to claim medical benefits in Germany and throughout the EU. In the long term, however, the European Health Insurance Card does not replace the benefits of comprehensive health insurance in Germany.

Some expats require private insurance in Germany. These include, for example, international students who are completing a language or preparatory course and visiting academics.

What benefits does private health insurance offer?

The scope of private health insurance benefits is agreed upon individually in the insurance contract and guaranteed by the private health insurance providers for the entire contract term. Changes in the scope of benefits are possible by changing tariffs or booking/canceling additional modules.

Privately insured patients can also use the services of private doctors who are not licensed by the public health insurance scheme.

How to choose private health insurance in Germany

The following points are critical, finding good private health insurance providers and tariffs:

- Free choice of doctor

- Direct access to specialists without referral of a general practitioner

- Reimbursement of costs for dental and vision care according to the maximum rates of the medical fee scales (dentures: at least 75%)

- Reimbursement of costs for medical aids — for example, wheelchairs or prostheses — not according to lists, but to medical necessity

- Reimbursement of costs for alternative practitioner treatments (if desired)

- Free choice of hospital, 2-bed or private rooms and treatment by chief physician for hospital stays

- Daily sickness allowance (not automatically included in private insurance)

- Health insurance cover abroad (usually unlimited in the EU, cover abroad should be valid for at least one year in other countries).

How much does private health insurance cost?

Private health insurance contributions are often cheaper than those for public insurance, especially for young and healthy people.

Factors influencing the premium amount:

- Scope of benefits of the tariff

- Age and health status when conducting the contract

- Deductibles

- Professional and private risk profile

In the case of pre-existing conditions, private health insurance companies can refuse insurance, charge risk surcharges, or exclude certain benefits. High-risk professions or hobbies may have the same effect.

Premium refunds are granted by some private health insurance providers if no benefits are claimed over a certain period. They are higher in tariffs with a low deductible.

For salaried employees, the employer pays half of the insurance premium.

When will insurance premiums increase?

Private health insurance companies calculate their premiums for a group whose members are of the same age and have comparable risk profiles at the start of the insurance. The premiums they pay must cover all insurance expenses for this group. If this balance is no longer achieved, private health insurance companies increase the premiums.

Between 2013 and 2023, premiums of private health insurance providers rose by 2.8%, while premiums for statutory health insurance increased by 3.4%.

Private health insurance companies will not increase individual premiums due to frequent, long-term or serious illness.

To keep premiums stable for seniors, private health insurance providers must build up old-age provisions of at least 10% of the monthly premium.

Best private health insurance for expats in Germany

By comparing different private health insurance providers and tariffs, you can find a policy that best meets your needs. Expert advice can be helpful here, as there are sometimes significant differences between the benefits and conditions of the various private health insurance companies.

The Berlin-based FinTech Getsafe offers digital advice on choosing the right private health insurance. The company itself has various insurance products — private liability, legal protection, household contents, dog liability, pet health insurance and private supplementary dental insurance — in its range. Additionally, the private provider is an advisor and broker for private health insurers.

Below, we present the private health insurance policies from ottonova and Feather, which are ideal for expats in Germany. Both private health insurance providers are high-performance digital insurance companies. All insurance matters can be managed quickly and easily via digital channels. Services and personal support are available in German and English.

ottonova

The FinTech insurance company ottonova specializes in various health insurance products. In addition to comprehensive private health insurance, the health insurance provider offers supplementary private dental insurance, supplementary hospital insurance, and company health insurance for businesses. The independent analysis company Morgen & Morgen has given ottonova’s health tariffs top marks. In a test conducted by Money magazine, the health insurance provider was ranked first for its excellent customer service.

ottonova’s private health insurance is available in two versions —regular private health insurance and special expat insurance.

Digital services in the ottonova mobile app

All ottonova services are available in a mobile app. The private health insurance provider offers a so-called concierge service here. Medical services, doctor’s appointments, and personal consultations can be ordered via app. Medical documents such as doctor’s letters or X-rays are stored in the app, which also has a reminder function for appointments and recommended treatments. Healthcare services are billed directly in the app.

ottonova’s regular offer is open to employees, freelancers, the self-employed, students and civil servants. On the ottonova website, you can calculate your personal offer and then decide whether you would like personal advice, check the offer, or take out your insurance directly online.

Rates in ottonova’s regular insurance

There are five different tariffs to choose from, which ottonova markets as Premium Economy, Business Class, Business Class Pro, First Class, and First Class Pro+.

Some benefits can be flexibly configured in all tariffs, influencing the monthly premium. These include:

- Deductible: 10%/maximum €500 per year, 25%/maximum €1,250 per year, 50%/maximum €1,000 per year

- Daily sickness benefit: between €50 and €100 per day

- Old-age provisions: between €100 and €460 per month.

ottonova insurance for expats who stay in Germany temporarily

ottonova insurance for Third-country nationals with a maximum stay of 5 years is aimed at employees, the self-employed and freelancers, students, post-docs, and researchers. You can insure your whole family under these policies, subject to contributions.

The ottonova expat policy offers comprehensive coverage in 4 tariffs, with some differences regarding hospital accommodation and visual aids. They apply not only to Germany and your home country, but worldwide and offer all the benefits of private health insurance, including treatment by the head physician during an inpatient stay, free choice of doctor, and full coverage of dental treatments (excluding dentures).

Employees pay for this insurance:

- First Class Expats: €167, €500 deductible

- Premium Economy: €263, €500 deductible

- Business Class Pro: €325, no deductible

- First Class Pro+: €352, €500 deductible

Feather Insurance

The Berlin-based FinTech Feather offers various digital insurance products. Its portfolio includes private liability insurance, legal expenses insurance, household contents insurance, supplementary dental insurance, and comprehensive private health insurance. Feather has specialized strongly in expats with its offers.

Feather offers all the benefits of a comprehensive private health insurance provider. The premiums for the insurance can be calculated on the Feather website in the first step, after which an offer is sent by e-mail. Expert advice is also offered as an option.

The insurance is available in three tariffs. Medical practitioner costs are not reimbursed. Return transportation is only included in the two higher-priced tariffs. Worldwide cover outside the EU is limited to one month. There is no excess for the Feather tariffs.

How do I apply for private health insurance?

You can apply for private insurance directly with the private health insurance companies, or seek advice from a health insurance broker. Ideally, this should be an independent insurance consultant. You can almost always apply for private health insurance online.

If you have pre-existing conditions or other high risks, you should always work with a health insurance broker when looking for insurance. Private health insurers in Germany operate a joint information system in which, among other things, they file rejections of insurance applications. It can then be difficult for those affected to obtain private health insurance at all. The broker, therefore, anonymously asks various insurance companies whether and on what terms insurance can be taken out. A positive solution is often possible in this way.

Health questions

The insurance application contains various health questions and questions about professional and private risks relevant to your health insurance. You must answer these questions completely and truthfully. Otherwise, you risk losing your insurance coverage.

Private health insurance companies use the health questions to assess the risk and, therefore, also to calculate the premium.

Waiting periods

If you have not previously had health insurance in Germany, there is a general waiting period of at least 3 months for private insurance. An 8-month waiting period applies for dental treatment, childbirth, and psychotherapy. There are no waiting periods after accidents for the subsequent insurance of children or your spouse, and usually also if you already have German health insurance.

Conclusion: Is private health insurance worthwhile?

Private health insurance is particularly worthwhile if it is taken out at an early age and without pre-existing conditions. The scope of private health insurance benefits almost always significantly exceeds the standard benefits of statutory health insurance. You can put together your tailor-made insurance cover by choosing the right private health insurance provider and tariff.

If you choose private health insurance, it is essential that you can afford the insurance in the long term. A crucial point is starting a family — private health insurance does not provide premium-free co-insurance for spouses or children.

Expats in Germany can find particularly high-performance private health insurance offers from digital private health insurers such as ottonova or Feather.

Frequently asked questions

Compared to the public German healthcare system, private insurance offers a greater choice of benefits. Young, healthy policyholders also benefit from low premiums. However, private insurance companies do not offer non-contributory family insurance.

Returning to a statutory health insurance scheme is usually unavoidable if your income falls below the compulsory insurance threshold. If you foresee that your income will rise again in the future, you can take out qualifying insurance for your private policy and then return to private insurance without new health questions, if you meet the requirements once more.

Termination of a private health policy is not advisable for two reasons. Due to more advanced age and possible previous illnesses, you must usually expect higher premiums and would lose some of your old-age provisions. It is better to switch to a different tariff with your current private health insurer.

Private insurance in Germany also includes compulsory long-term care insurance, the benefits of which correspond to those of statutory nursing care insurance. The policy can be taken out with the same company or other private health insurers.