How we earn our money

We finance our services on how-to-germany.com through affiliate programs.

When a user orders a financial product through our site and their application is approved, we may receive a commission from some providers. It’s important to note that this does not in any way influence our independent ratings and recommendations.

All the products we present on how-to-germany.com are selected for their quality, range of services, and excellent value for money.

Business Credit Cards in Germany

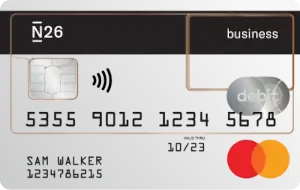

- N26 Business Standard Mastercard – Best business credit card for freelancers and self-employed in Germany.

What are Business Credit Cards?

Business credit cards are financial tools specifically designed to cater to the needs of businesses, entrepreneurs, and self-employed individuals. They offer a range of features and benefits tailored to facilitate business-related expenses such as travel, purchasing supplies, and managing cash flow. Business credit cards provide a convenient and separate line of credit from personal finances, simplifying accounting processes and enabling better expense tracking.

Business Cards vs Corporate Cards

Business credit cards are typically issued to small and medium-sized enterprises (SMEs), freelancers, and self-employed individuals. They often have lower credit limits, require less stringent qualifications, and may offer rewards tailored to business needs.

On the other hand, corporate cards are usually provided to large corporations and come with higher credit limits, specialized reporting tools, and customizable features that cater to the specific requirements of the organization.

Pros and Cons of Business Credit Cards

Before diving into the specifics of business credit cards in Germany, let’s explore the advantages and disadvantages they offer:

- Improved cash flow management

- Separation of personal and business expenses

- Enhanced expense tracking and reporting

- Access to rewards and cashback programs

- Potential for building business credit history

- May require a personal guarantee for approval

- Potential for high-interest rates if balances are not paid in full

- Limited credit limits compared to corporate cards

Fees of Business Credit Cards

Business credit cards may come with various fees, including annual fees, foreign transaction fees, and fees for additional cards. It’s crucial to consider these costs when comparing different options. While some cards may have higher annual fees, they often provide added benefits that justify the expense. It’s essential to evaluate the fee structure and weigh it against the card’s features and rewards program.

Features of Business Credit Cards

When selecting a business credit card in Germany, consider the following key features:

- Credit Limit: Assess the offered credit limit to ensure it meets your business requirements.

- Rewards Program: Evaluate the rewards structure, including cashback, airline miles, or points, to match your spending patterns and maximize benefits.

- Expense Management Tools: Look for cards that provide expense tracking and reporting tools to simplify bookkeeping and accounting processes.

- Travel Benefits: If your business involves frequent travel, explore cards that offer travel-related benefits such as travel insurance, lounge access, and airline rewards.

- Introductory Offers: Some cards may provide introductory 0% APR periods, allowing interest-free borrowing for an initial period.

Compare Business Credit Cards in Germany

When comparing different business credit card options in Germany, consider factors such as interest rates, rewards programs, fees, and additional benefits. It’s essential to prioritize features that align with your business’s unique requirements. Comparing cards side by side using comparison websites or consulting financial advisors can help in making an informed decision.

How to Get a Business Credit Card?

To obtain a business credit card in Germany, you’ll typically need to meet certain requirements and follow specific steps:

Requirements

- Business Registration: Provide proof of your business registration or self-employment status.

- Financial Documents: Include financial documents such as bank statements, income tax returns, and profit/loss statements to demonstrate your business’s financial stability.

- Personal Guarantee: Be prepared to provide a personal guarantee, especially if your business is new or has limited credit history.

- Identification: Submit valid identification documents such as a passport or identification card.

Process

- Research and Compare: Explore different business credit card options, considering their features, benefits, and fees.

- Application: Fill out the application form provided by the credit card issuer, ensuring accuracy and completeness.

- Documentation: Gather the necessary documents, including business registration proof, financial documents, and identification.

- Submission: Submit the application and required documents to the credit card issuer through their designated channel, such as online or in-person.

- Verification and Approval: The credit card issuer will review your application and documentation, conducting necessary verifications. Once approved, you will receive your business credit card.

Conclusion

Choosing the right business credit card in Germany is crucial for managing your business finances effectively. Consider the features, rewards programs, fees, and requirements of each card to find the one that aligns with your business needs. By conducting thorough research, comparing options, and understanding the application process, you can make an informed decision and select a business credit card that enhances your financial management capabilities.

Frequently Asked Questions

Business credit cards are specifically designed for business-related expenses and often offer features such as expense tracking, rewards tailored to business needs, and improved cash flow management. Personal credit cards are intended for individual use and may not provide the same business-focused benefits.

Typically, business credit card fees may be tax-deductible in Germany. However, it’s recommended to consult a tax advisor or accountant to understand the specific rules and regulations regarding tax deductions for business expenses.

Yes, freelancers and self-employed individuals in Germany are eligible to apply for business credit cards. However, the specific requirements and documentation may vary depending on the credit card issuer and your financial situation.

Some business credit cards in Germany provide travel insurance coverage as part of their benefits. It’s important to review the terms and conditions of the card and its insurance offerings to understand the extent of coverage provided.

While it’s generally recommended to keep personal and business expenses separate, using a business credit card for occasional personal expenses may be possible. However, it’s crucial to maintain clear records and separate business and personal transactions to avoid any accounting complications.