How we earn our money

We finance our services on how-to-germany.com through affiliate programs.

When a user orders a financial product through our site and their application is approved, we may receive a commission from some providers. It’s important to note that this does not in any way influence our independent ratings and recommendations.

All the products we present on how-to-germany.com are selected for their quality, range of services, and excellent value for money.

Credit Cards in Germany – Guide for Expats

- Most banks in Germany offer charge credit cards — you repay the full amount each month. Revolving credit cards let you pay in installments, but with interest.

- Your Schufa score (credit rating) decides what credit card and limit you can get.

- If you’ve been in Germany a while and have regular income, look at the Hanseatic Bank GenialCard or awa7® Visa — both are free, interest-free for 3 months, with adjustable repayment rates and a user-friendly mobile banking app in English. The Hanseatic Bank GenialCard is the best credit card in Germany of all the cards we tested.

- New in Germany? Look at the TF Mastercard Gold or Gebührenfrei Mastercard Gold — both free, offer repayments in monthly installments, travel insurance, discounts, and mobile banking apps in English. The TF Mastercard Gold is the best credit card for starters in Germany.

- The miles and rewards programs aren’t big in Germany. If you fly a lot, look at Lufthansa or Eurowings credit cards, which are part of the Miles & More program. For shopping cashback, look at AMEX PAYBACK, but note AMEX isn’t as widely accepted as Visa or Mastercard.

Most banks will offer their websites only in German. Translate the pages using the Chrome browser’s built-in feature (Right-click → Translate to English). If a button or link is unresponsive, revert to the German version and retry.

Types of Credit Cards in Germany

There are four types of credit cards in Germany: a revolving credit card, a charge credit card, a prepaid credit card, and a debit card. Each has its unique features and benefits tailored to different user needs.

Revolving Credit Card – Monthly Billing and Option for Installment Payments

In Germany, the term “Kreditkarte” describes all varieties of credit cards. However, revolving credit cards stand out as the only “real” credit cards in the classical sense. With this card, all the purchases are added together over a month, and the user gets an interest-free payment period of usually four weeks. Depending on the German credit card provider, this period might be longer. After this time, credit card users can decide if they want to pay the total amount due or in installments. If they opt for installments, they’ll be charged interest based on a percentage of the amount they owe. This interest rate can change depending on the credit card bank. This kind of loan is more adaptable than a fixed-term loan.

Due to their installment payment feature, revolving credit cards are often only provided to individuals with a clean credit history, a stable income, and no negative records. Prepaid credit cards or debit cards are often more appropriate for those with unstable earnings or students.

Charge Credit Card – Monthly Deduction of Accumulated Charges

Charge credit cards are the most popular in Germany. With this card, the credit card company sends a monthly bill and then automatically takes the amount you spent from your linked bank account. This gives you a short-term “loan” of up to four weeks, allowing you to buy things even if you don’t have sufficient funds in your account yet. But, ensuring your account can cover the costs at month’s end is crucial. Otherwise, you might face additional fees.

Unlike revolving credit cards, with charge credit cards, you can’t usually pay in installments. The total amount is taken all at once. However, sometimes arrangements can be made with the credit card provider. When getting a credit card, you can typically choose between a charge credit card and a regular revolving credit card.

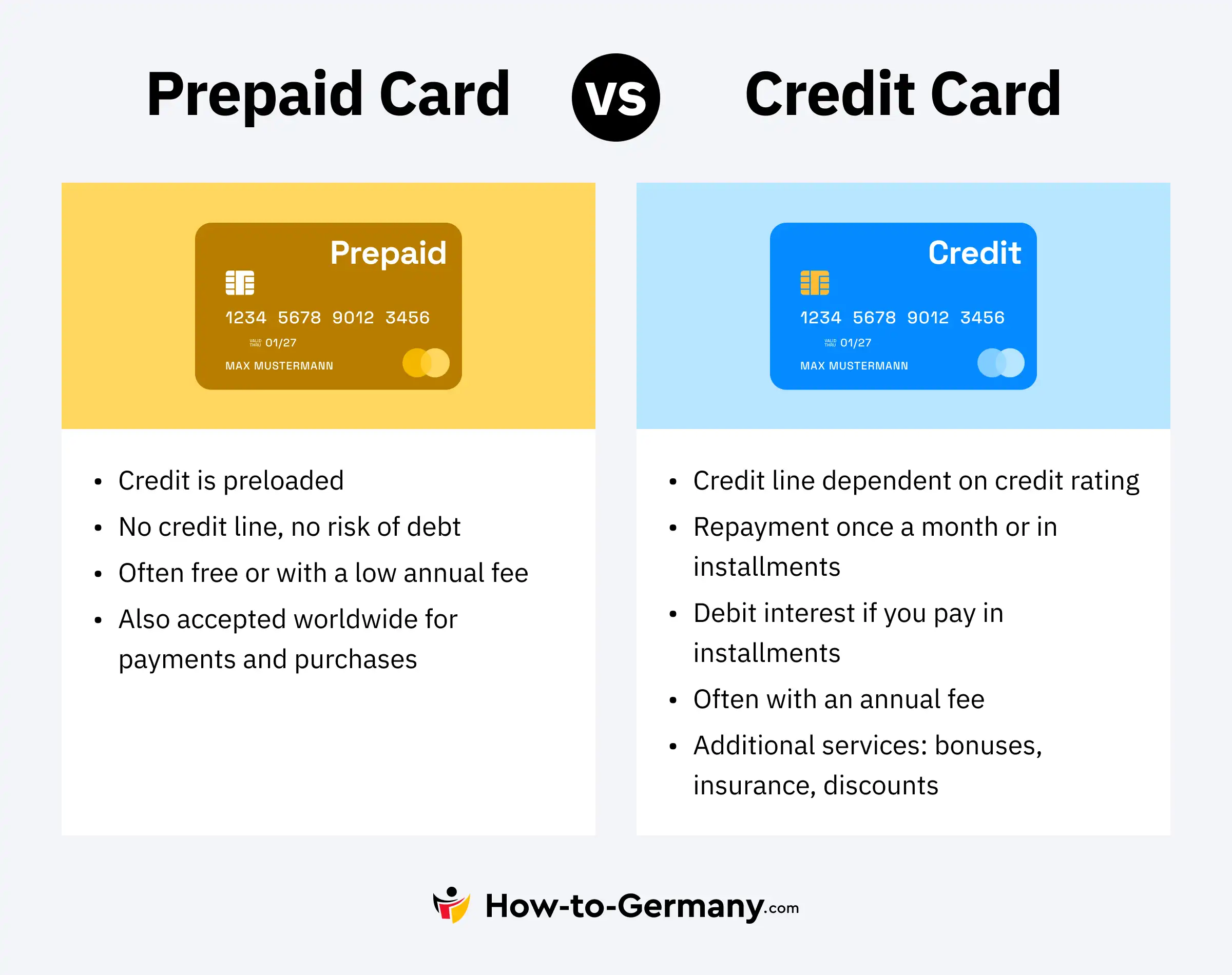

Prepaid Credit Card – Requires Preloading the Card Account

A prepaid credit card isn’t like a typical credit card. It only works if you’ve added money to the credit card account beforehand. Think of it as refilling a mobile phone: you can use it as long as there’s a balance. Without funds, the card won’t work until reloaded.

For students or those with fluctuating income who can’t get a standard credit card, prepaid credit cards are a great choice. They offer control over expenses since you can only spend what you’ve loaded. There’s no risk of unexpected debt or overspending. Plus, if someone steals the card, they can only use up to the loaded amount, making prepaid cards a secure payment method.

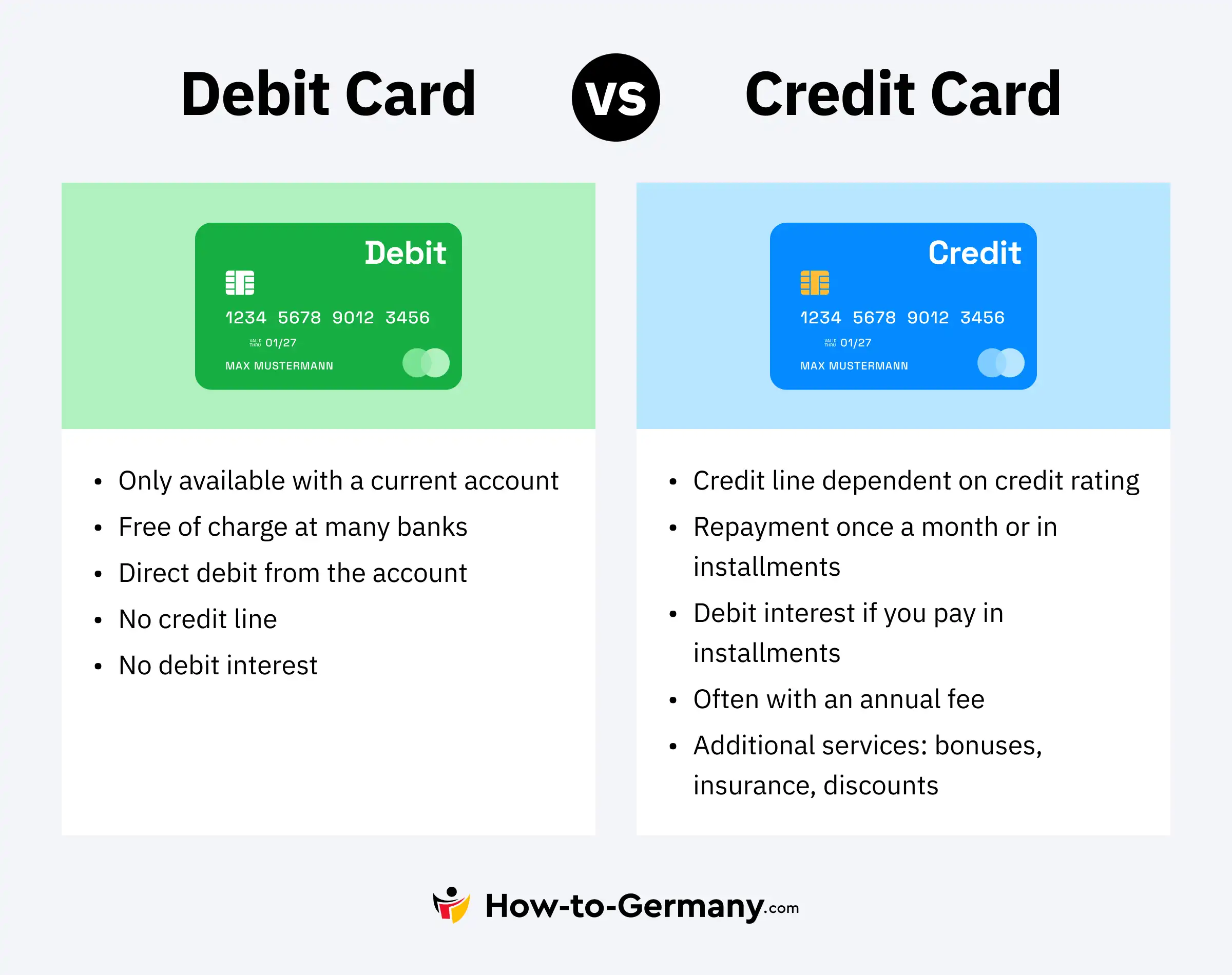

Debit Card – Direct Deductions from the Bank Account

Using a debit card, the amount for any purchase or service is taken immediately from the associated current account. Unlike credit cards, debit cards don’t offer credit. However, you can still use them for many functions that a credit card offers: withdraw cash, make contactless payments, and make online purchases. Debit cards aren’t standalone; they’re always linked to a checking account. They’re ideal for those who want a direct overview of their spending.

The Schufa Check and its impact on Credit Card Applications

In Germany, while anyone can apply for a credit card, there are some basic requirements that need to be met, such as being a resident in Germany and being of legal age. Beyond these basic criteria, credit card providers often have additional conditions that applicants must satisfy to get a credit card. Therefore, the type of credit card you can obtain often depends on your credit history.

When applying for a German credit card with a credit limit, banks consider this a potential risk. To evaluate this risk, they conduct a credit check to access data on an applicant’s payment history. This data is sourced from Germany’s largest credit reporting agency, Schufa.

If you have a negative Schufa record due to a delay in payment or similar reasons, chances are you might not be approved for such a credit card. It’s crucial for the bank to ensure that the customer can repay any borrowed money in a timely manner.

However, debit and prepaid credit cards are usually issued without a prior Schufa check. Since these cards don’t offer actual credit, they don’t pose a significant risk to the bank. Yet, they still provide users with the essential features of a credit card, including cashless transactions and cash withdrawals from ATMs.

Fees associated with German Credit Cards

With a classic or revolving credit card in Germany, holders have to reckon with interest when they use the option of flexible repayment. Specifically, if the credit card bill is not fully paid within the interest-free period and instead, a longer repayment period or installment is chosen.

The interest rates can be very different, based on the credit card provider. There can also be additional fees when using the credit card outside Germany or when making cash withdrawals from ATMs. Beyond these fees, some credit card providers may also have an annual fee, which can vary significantly.

Annual Fee

Not every credit card has an annual fee. Typically, cards that offer more than the basic features charge this fee. These additional features can range from discounts, bonus programs, to insurance benefits like travel or rental car insurance. The more features a credit card has, the higher the annual fee tends to be. Cards that offer many high-quality features often come with a higher fee. If these extra features are not useful to you, it’s better to choose a standard credit card. While some benefits, like insurance or discounts, can save money, they’re only beneficial if used. For instance, if someone only travels once a year, travel insurance or a frequent flyer program might not be useful. But for frequent travelers, these features can offer great value.

It’s also important to remember that even credit cards without an annual fee might have other costs. So, it’s always a good idea to check the terms or ask the credit card provider about all potential fees before getting a card. The extra services offered by the credit card are often provided because they also bring profits to the credit card provider.

Foreign Currency Fee

When using credit cards outside countries of the eurozone, credit card providers like VISA, MasterCard, American Express, and Diners Club are very useful due to their wide global acceptance. They can be used almost anywhere. When you pay or withdraw cash in a foreign country, the transaction is processed in the respective national currency. For this convenience, many credit card providers charge a foreign currency fee.

The foreign currency fee can vary a lot, typically ranging from 1.5% to 5% of the transaction amount. If you frequently travel and make payments in foreign currencies, it might be beneficial to get a credit card that doesn’t charge foreign transaction fees. Otherwise, these fees can add up quickly over time.

Cash Withdrawal Fee

Credit cards are a widely accepted payment method. They are practical, especially when you don’t have exact change at the checkout or when shopping online. Yet, there are times when cash is preferred or necessary. Fortunately, credit cards allow you to withdraw money as well.

The fees for withdrawing cash using a credit card depend on the provider. The amount they charge can vary. Some credit card providers permit a certain number of free cash withdrawals per month or year, and then charge a fee for any additional withdrawals. Others might allow free cash withdrawals only at their bank’s ATMs.

It’s also crucial to note where the free cash withdrawals apply. With some credit cards, you can withdraw cash without any fee worldwide. With others, free withdrawals might be limited to Germany or countries within the eurozone. And, there are credit cards that don’t offer free cash withdrawals at all.

Please note: Any additional fees charged directly by the ATM company are separate from the credit card provider and are not considered as part of the credit card fees.

Interest Rates

Credit cards often provide a monthly credit limit to cardholders. Traditional credit cards also offer the option to repay the borrowed amount in monthly installments. When cardholders choose this repayment method, they are required to pay interest on the borrowed amount. Typically, the interest rate for credit cards is variable and is charged only on the borrowed amount, not the entire credit limit.

When comparing different credit card offers, it’s essential to focus on the effective annual interest rate rather than just the nominal or borrowing rate. The effective annual interest rate gives a complete picture of the total interest costs, whereas the nominal rate only indicates the monthly interest charge, making it appear lower.

If you’re considering getting a credit card and intend to use the installment repayment feature, it’s crucial to research the interest rates first. This will help you understand how cost-effective the card is for your specific needs.

Best Free Credit Cards for Established Expats

These cards offer the best conditions but require a long and clean credit history (Schufa).

Hanseatic Bank GenialCard

The Hanseatic Bank GenialCard is the best credit card in Germany, perfect for frequent travelers and online shoppers. It offers no annual fee, no foreign transaction fees, and free worldwide cash withdrawals (note: ATM operators may charge their own fees). The card supports contactless payments and is compatible with Apple Pay and Google Pay. Users can choose between full repayment or flexible installments, with the first three months of installment payments being interest-free. Additional perks include up to 7% discounts on travel bookings and access to exclusive shopping deals. No new bank account is required to apply.

awa7® Visa

The awa7® Visa is a sustainable, fee-free credit card in Germany that combines financial convenience with environmental responsibility. For every €100 spent, awa7® protects one square meter of existing forest, and seven trees are planted upon card activation. The card offers no annual fee, free worldwide cash withdrawals, and no foreign transaction fees. It supports contactless payments and is compatible with Apple Pay and Google Pay. Flexible repayment options are available, with payments automatically debited from your existing bank account. While the card does not include built-in insurance, optional coverage can be added for an additional fee.

Barclays Visa

A completely free credit card that offers some of the best conditions a credit card can have. However, we have recently stopped recommending it since the approval rates are very low for foreigners and the mobile banking app is only in German.

Best Free Credit Cards for Beginners

Unlike the previous ones, these cards are much easier to get. This doesn’t necessarily mean you’re automatically approved when you apply. But you have a better chance of getting approved with these credit cards than with the others.

TF Mastercard Gold

TF Bank Mastercard Gold is the best credit card for starters in Germany, ideal for new expats without a long credit history. It comes with no annual fee, no fees for cash withdrawals, and no foreign currency fees. The card offers travel insurance and a 5% cashback on travel and rental car bookings. Just remember to cover at least 50% of the travel booking with the card to get the insurance benefit.

Gebührenfrei Mastercard Gold

Advanzia Gebührenfrei Mastercard Gold is also a great credit card for starters in Germany. It’s easily accessible to expats, and you don’t need a long credit history to get one. It has very similar conditions to the TF Mastercard Gold. The credit card is free, has no annual fee, and there are no fees for cash withdrawals or foreign currency fees. However, there’s a small-hidden currency conversion surcharge fee. Additionally, it also comes with travel insurance and a 5% cashback on travel and rental car bookings.

Best Cashback Credit Cards in Germany

When it comes to cashback, the credit card that offers the most points or cashback rewards will rank the highest.

American Express Payback

While this credit card falls in some parts compared to the others, it does hold one of the better cashback points in Germany. In most cases, it doesn’t matter if the store is not a partner; you will still get cashback points for your purchases. It is a charge credit card, meaning that you cannot repay the borrowed amount in monthly installments.

Best Student Credit Cards in Germany

Students coming to Germany will typically not have a long credit history or complete documents. Their financial situation will also be limited compared to most. So the best credit cards for students will be those with high approval rates while offering the benefits of financial flexibility.

Best Travel Credit Cards in Germany

The best credit cards for travel are those that offer the most perks related to traveling. This includes travel insurance, miles, travel-related points, discounts, access to the airport lounge, and more.

Best Business Credit Cards in Germany

The best business credit cards in Germany typically offer competitive rewards programs tailored to business needs, including cash back, travel rewards, or discounts on business expenses like office supplies and travel.

How to get a German Credit Card: Step-by-Step Guide

Here’s a quick step-by-step on how to apply for any German credit card.

Step 1: Check Your Eligibility

As with any product, each credit card will have its eligibility requirements. The most common eligibility requirements for German credit cards are that you must at least have a German bank account, a German phone number, a valid passport, and be at least 18 years old.

To check your eligibility with the credit card you’re interested in, simply follow the link to their application page.

Step 2: Fill-Out Online Application Form

Credit card online applications will ask for your personal details. This includes your name, address, birthdate, and contact information. If you’re asking for a certain credit limit, you must include information about your income in your application.

Most banks will offer their websites only in German. Translate the pages using the Chrome browser’s built-in feature (Right-click → Translate to English). If a button or link is unresponsive, switch back to the German version and retry.

Step 3: Pass Video Identification Process

After you submit your online application form, the next step is to wait for the bank to contact you through the contact information you provided. Once they contact you, you must verify your identity with them. How this is done would depend on the bank in question, but typically, it may involve doing a video call with their customer service agent.

After the agent verifies your data and information, you only need to wait for them to send your card and other important information about it, either to your email or with your card in a physical document.

Conclusion

Credit cards are a great way to expand your financial freedom when used and managed wisely. It is also one of the few financial tools available that provide you with more benefits and advantages the longer you have it and the more you use it.

The credit cards listed above all offer excellent benefits, but overall, we believe that the TF Bank Mastercard Gold is the best credit card in Germany due to its excellent terms and perks.

Frequently Asked Questions

Yes, foreigners can get a credit card in Germany. But depending on some factors, foreigners might have a harder time getting approved for a credit card in Germany than Germans.

Free credit cards are credit cards that don’t have an annual or monthly fee, as well as other fees, such as foreign currency fees and cash withdrawal fees.

Visa and Mastercard are widely accepted in Germany. However, many small businesses will refuse to accept credit card payments, and some places will do so unless the purchase exceeds a certain amount.

There are four types of credit cards in Germany: charge credit cards, revolving credit cards, debit cards, and prepaid credit cards.

A charge credit card compiles all purchase payments within a 30-day period, after which a credit card statement is generated, which the owner must pay.

A revolving credit card is a credit card that gives owners a line of credit for them to use and the possibility to pay back in monthly installments.

A debit card is basically a card that’s connected to the owner’s bank account. Each time the debit card is used, the amount is automatically deducted from the bank account.

With a prepaid credit card, the owner must first transfer money from their bank account to the credit card before use.

The most common type of credit card in Germany is the charge credit card. Charge credit cards require the cardholder to pay the outstanding balance in full at the end of each month, rather than carrying a balance over time.

The best credit card in Germany is TF Bank Mastercard Gold due to its excellent terms and perks.

The easiest credit card to get approved for is one that is not strict with your credit history, among other requirements. Based on our research, these are TF Bank Mastercard Gold and Gebührenfrei Mastercard Gold.